KESD FY27 BUDGET INFORMATION

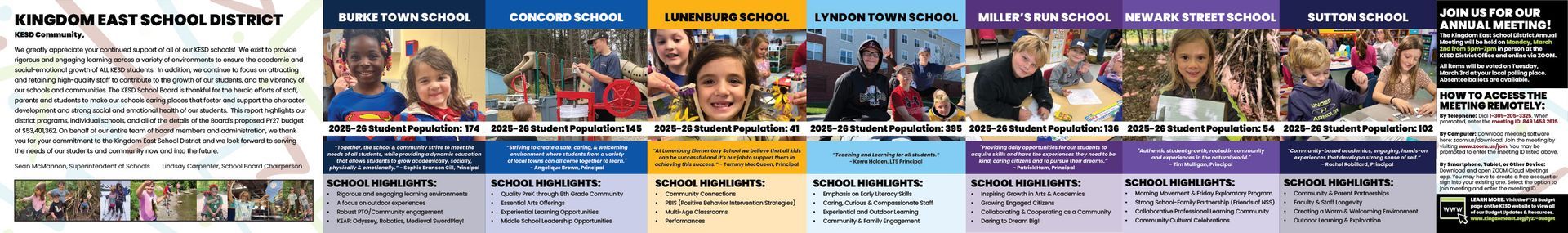

Kingdom East School District FY27 Budget

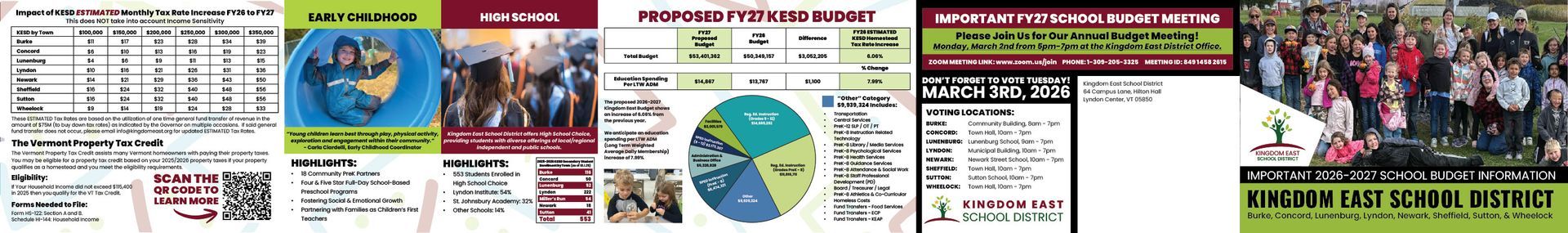

Upcoming Annual Community Meeting

Kingdom East School District invites families, staff, and community members to join us for our upcoming Annual Meeting, where voters will consider the proposed FY27 budget and other district business. This meeting is an important opportunity to learn more about how the budget supports our students, schools, and communities, and to engage in the democratic process that helps guide the future of KESD.

Monday, March 2nd, 2026

- Location: Kingdom East School District

- Time: 5PM

Join Meeting via ZOOM:

- Online ZOOM Login

- Phone Login Info: +1-309-205-3325

- Meeting ID: 849 1458 2615

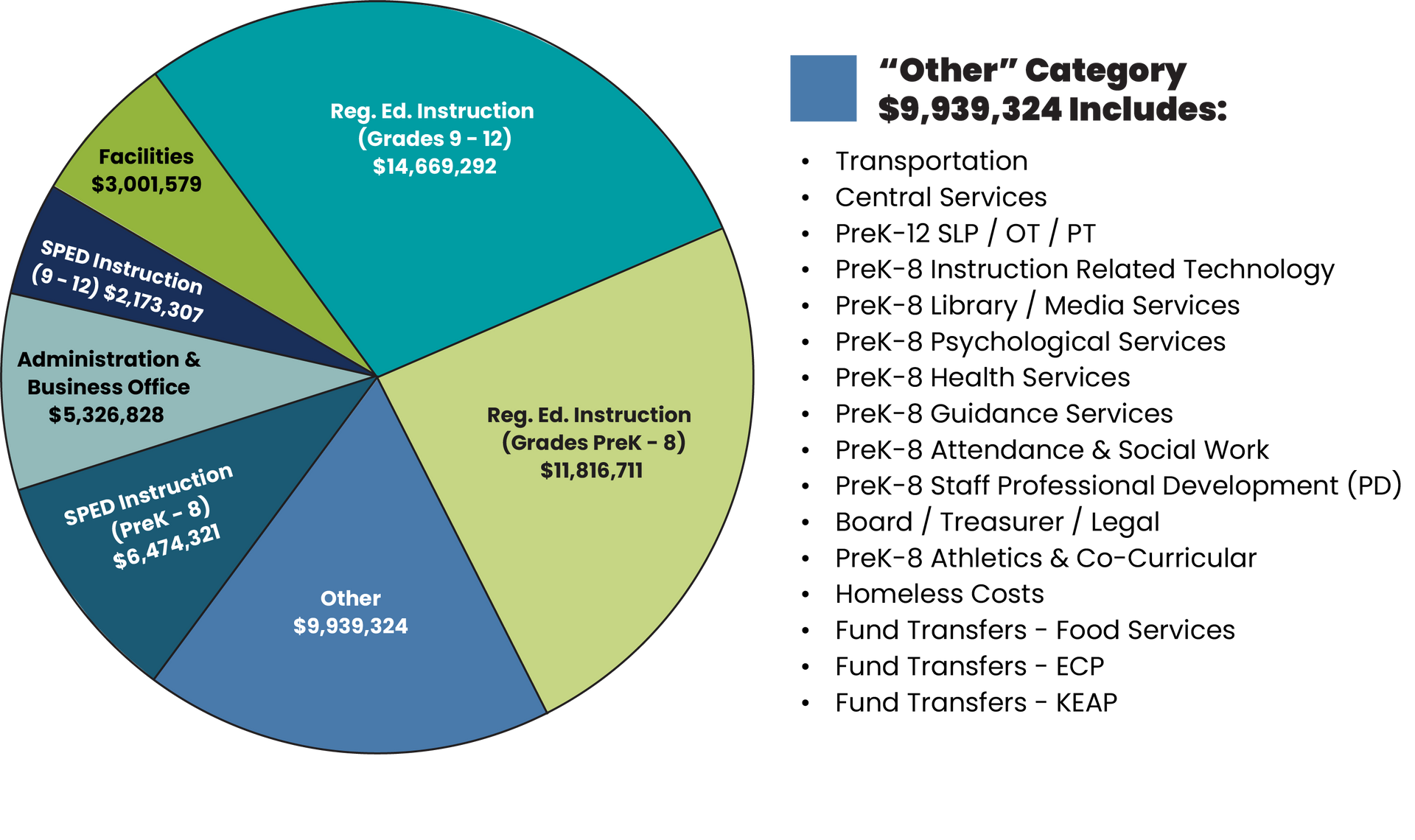

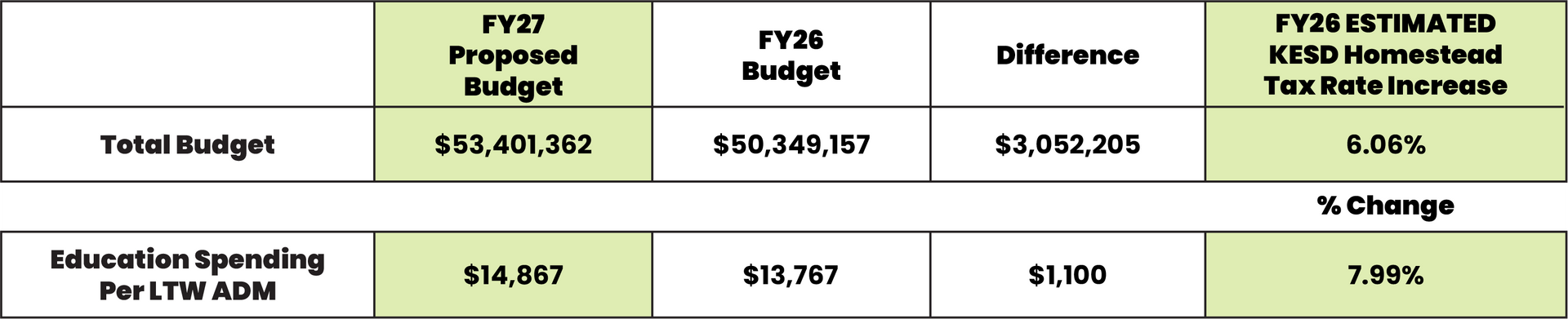

Proposed FY27 KESD Budget

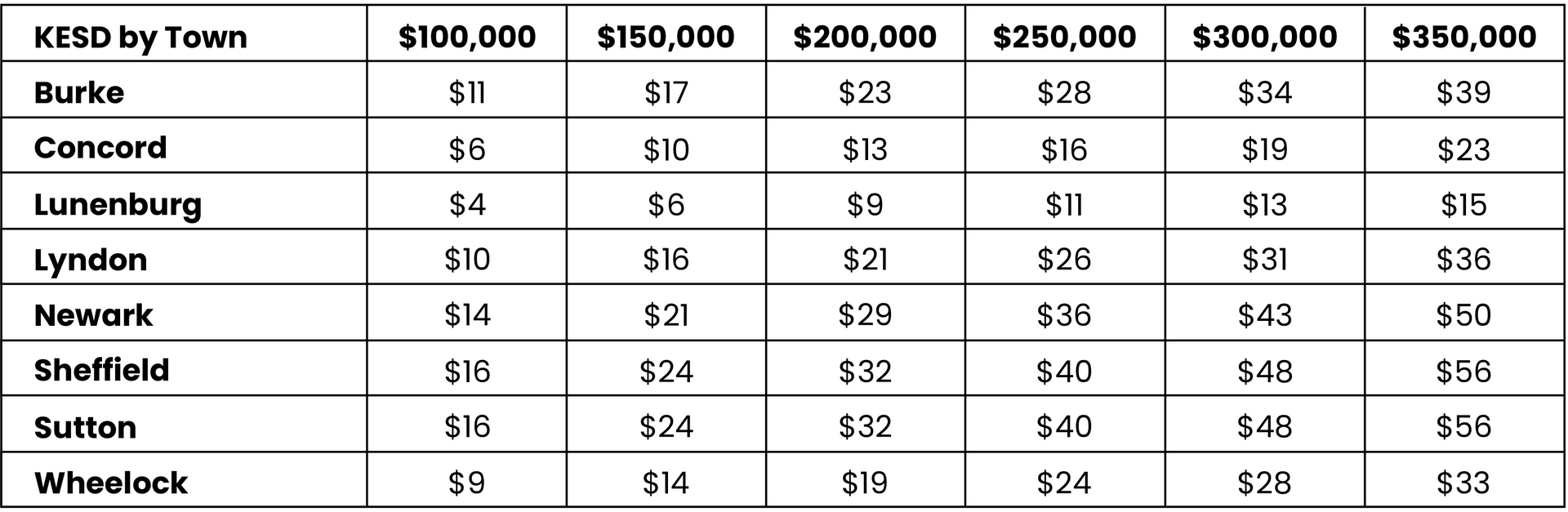

These ESTIMATED Tax Rates are based on the utilization of one time general fund transfer of revenue in the amount of $75M (to buy down tax rates) as indicated by the Governor on multiple occasions. If said general fund transfer does not occur, please email info@kingdomeast.org for updated ESTIMATED Tax Rates.

The Vermont Property Tax Credit

The Vermont Property Tax Credit assists many Vermont homeowners with paying their property taxes. You may be eligible for a property tax credit based on your 2025/2026 property taxes if your property qualifies as a homestead and you meet the eligibility requirements.

Eligibility:

If Your Household Income did not exceed $115,400 in 2025 then you qualify for the VT Tax Credit.

Forms Needed to File:

- Form HS-122: Section A and B.

- Schedule HI-144: Household Income

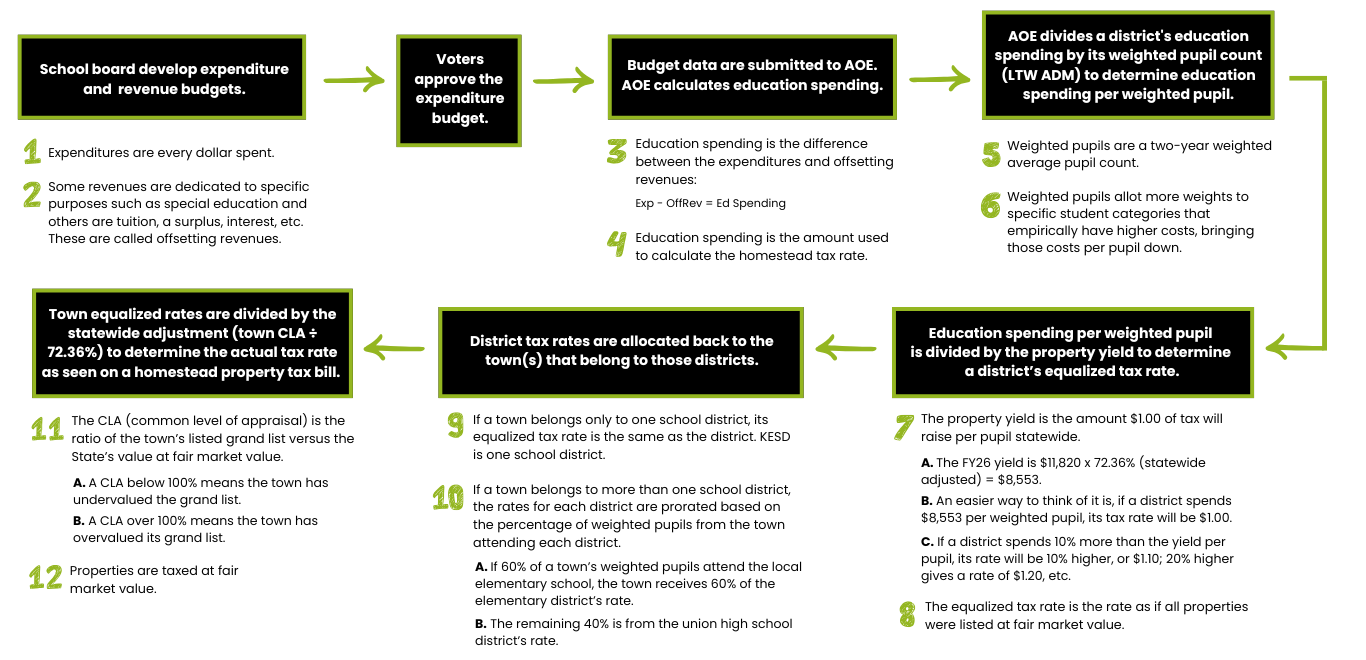

How Education Tax Rates are Calculated